Financial security tends to weigh heavily on the minds of those nearing retirement. People may find themselves wondering if they have all their ducks in a row and are truly set up to continue receiving a form of income through their golden years once they’ve cashed their last employer paycheck. Social Security helps, but it can’t be solely relied upon.

That’s where annuities can help close a gap and offer guaranteed income for life. CUNA Mutual Group offers numerous annuity types that investors can select based on their risk tolerance, and one such annuity type is the Group Zone Income™ Annuity. And we are pleased to announce that we are increasing our Guaranteed Lifetime Withdrawal Benefit (GLWB) rates on this annuity!

How Much is the Rate Increasing?

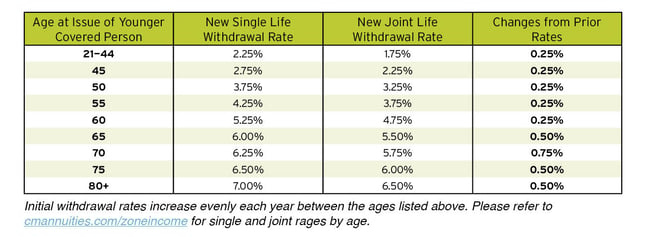

Rates are increasing such that at age 65, the Single Life Withdrawal Rate is 6% (5.50% for the Joint Life Withdrawal Rate). These new rates for contracts issued beginning June 10, 2022, are shown in the chart below. The Annual Increase Percentage isn’t changing and remains at 0.30%.

Why is the Rate Increasing?

At CUNA Mutual Group, we’re committed to helping consumers achieve financial security. Throughout these uncertain times, finances remain a top concern. This is especially true with current inflation numbers; seven-in-ten Americans view inflation as the top problem in the country today.1 With so much worry over whether people are able to afford living, it’s important to help clients get set up for stability before and after retirement.

How Does the Group Zone Income Annuity Work?

Consider this a new math for retirement. Oftentimes, clients may be looking for income and growth, rather than a stagnant check for the rest of their lives. From a retiree’s perspective, there’s also a lot of value in feeling secure that you have some protection against some of the effects of inflation and market volatility.

The CUNA Mutual Group Zone Income Annuity provides a blend of all-in-one growth potential and downside protection on top of that predictable income for life. “Zone” refers to the personalized comfort zone investors can create for themselves, deciding how much of their payment to allocate to which allocation options, then choosing a risk/reward zone for each index. This helps to instill a balance between growth potential and downside protection.

This annuity also allows investors to start receiving their lifetime income while the investment is still growing. The withdrawal rate increases each year clients hold their contract prior to starting income, to a maximum of 10 years.

This annuity also offers a Return of Premium (ROP) death benefit that leaves beneficiaries the amount of the original purchase payment (minus any withdrawals made during the holder’s life). That’s a valuable security that can promote peace of mind, knowing that everyone named and involved in the annuity can receive some financial protection in life or in death.

Feeling Secure in Retirement

It all comes down to feeling a sense of security in one’s finances. That’s something major that clients are looking for, and it’s why we’ve pushed forward with the GLWB rate increases on our Group Zone Income Annuity.

Are you or your clients familiar with this new annuity product yet? We encourage you to review our client guide, which provides a more in-depth look at the specifics of how it works and how it can benefit investors looking to set themselves up for growth while still ensuring a steady income.