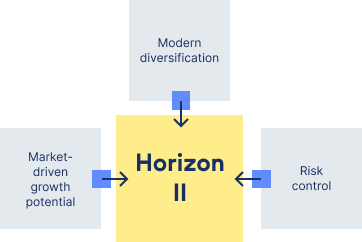

TruStage™ Horizon II Annuity

A modern approach to diversification

With TruStage™ Horizon II Variable Annuity, underwritten by MEMBERS® Life Insurance Company, your clients can diversify their dollars for growth potential and set a personalized measure of protection against loss for a portion of their money — all in one place.

Product information

How does TruStage™ Horizon II work?

- Clients divide assets among multiple variable subaccounts and risk control accounts to customize and diversify.

- One the variable side, options include funds from top-tier managers and covers the full range of asset classes.

- Horizon II has a 6-year risk control account and surrender period.

- Includes a return of purchase payment (ROP) death benefit that ensures the client's beneficiaries will receive a sum equal to the original purchase payment adjusted for any withdrawals, or contract value, whichever is greater.

Why do investors choose TruStage™ Horizon II?

- It is an option for a simple yet comprehensive investment platform with a measure of personalized, guaranteed loss protection.

- Clients can choose from among three pre-built express portfolios or an option to custom-build their own.

- “All-in” fees are highly competitive and transparent.

- It also features a way for clients to protect their legacy for loved ones.

Explore other TruStage™ annuity products

Fixed

annuities

You can offer a stable, tax-deferred way for risk-averse clients to grow their savings and guarantee income to help pay for retirement.

Income

annuities

Clients nearing (or in) retirement may need help creating a strategy for a steady stream of income.

Registered index-linked annuities

Registered index-linked annuities (RILAs) can offer clients market-linked growth potential balanced with a measure of downside protection.